Mortgage Calculator / Amortization Calculator

How to Calculate Mortgage or Amortization Schedule

An amortization schedule is a tool that financial lenders use to determine the overall monthly payment of a loan. The monthly payment is composed of two parts: the interest and the principal.

The interest is the portion that compensates the bank for lending money. The interest rate is a function of the risk of the loan. The riskier the loan is, the higher the interest rate.

Factors that can affect the interest rate are the length of the loan (longer is riskier), if there is collateral (no collateral is riskier), and the borrower’s credit score (a lower score is riskier). Interest is treated as income to the lender.

The other part of the monthly payment is the principal, which is a portion of the amount that was borrowed. This part of the payment lowers the balance of the loan. This is treated as cash to the bank and can be lent out as a new loan.

Assuming the rate is fixed, the interest portion of the loan will initially be high and then gradually go down over time.

On the other hand, the principal portion will initially be low and then increase over time. This is because the interest rate is applied to a high loan balance at the start and a small loan balance towards the end.

How to Calculate a Loan Payment

A loan payment can be calculated in several ways, and one of the easiest is using this calculator. Other calculators can do this as well.

To calculate a monthly loan payment, the loan amount, interest rate, and term must be known, and then the calculator above can compute the monthly principal and interest (P&I) payment. This payment is what will amortize the loan to $0 at the end of the loan term. Let’s look at each of the variables.

The first variable is the loan amount. The higher this is, assuming the interest rate and term don’t change, the higher the payment and total interest will be.

On the other hand, the lower the original loan balance is, and again assuming neither the interest rate nor term change, the lower the monthly P&I payment and total interest will be.

Next is the interest rate. Similar to the loan amount, the higher the interest rate is, the higher the payment and total interest will be. The lower the interest rate is, the lower the payment and total interest will be. Both of these are based on the assumption that neither the loan balance nor the term changes.

The final variable is the term. If the term increases, the monthly payment decreases and total interest increases. If the term decreases, the monthly payment increases and total interest decreases.

Again, we need to assume that neither the interest rate nor the loan amount have changed.

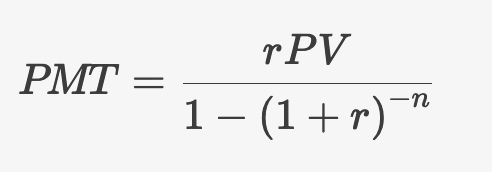

Loan Payment Formula

Using these variables you can apply the loan payment formula to calculate the monthly payment.

Where:

PMT = payment

PV = remaining principal (loan balance)

r = periodic interest rate

n = number of payments (term)

How to Calculate Interest

Total interest is calculated by totalling the interest column in the amortization schedule, which is shown with your calculation results using the amortization calculator.

As already mentioned, interest is initially high and then significantly decreases towards the end of the loan period. Let’s look at an example to see how this works.

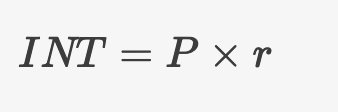

Loan Interest Formula

You can use the following formula to calculate the interest for each payment on the loan.

Where:

INT = interest for payment

P = remaining principal balance

r = periodic interest rate

For example, let’s assume a $30,000 car loan at 6% interest for 4 years. If we enter these amounts into the amortization calculator, we get a total monthly P&I payment of $704.55 and total interest of $3,818.47.

The first month the interest payment is $150.00 of the $704.55 monthly payment. This is calculated by multiplying the current loan balance of $30,000 by the annual interest rate of 6% and then dividing by 12.

The amount is divided by 12 because the interest rate is an annual rate, but we want to calculate a monthly payment.

After the first month, the balance falls to $29,445.45. The interest payment is now ($29,445.45 x 6%) ÷ 12 = $147.23, a slight decrease from the prior month.

Fast forward to the final payment. The balance for the previous month ended at $701.11. Now the interest payment is ($701.11 x 6%) ÷ 12 = $3.51, a significant decrease from the first month.

Now, let’s see how each column of the amortization schedule is calculated. Each row of the schedule is calculated the same way, just with slightly different numbers in the row.

Assuming the rate is fixed (which the calculator above does), the monthly payment will not change. In our example with a $30,000 car loan at 6% annual interest for 4 years, the monthly payment is $704.55. Each row shows a monthly payment of $704.55.

The principal column is found by subtracting the interest payment from the monthly payment. Or in other words, the monthly payment is the sum of the principal and interest.

The bank will make sure it gets paid first, so the first part of the payment goes to pay its interest, and then the remaining portion of the payment goes to lower the loan balance. As the interest payment decreases over time, the principal payment increases.

The interest payment calculation has already been discussed in the prior section. It is found by taking the previous month’s ending balance and multiplying it by the annual interest rate and dividing by 12.

The final column, the remaining balance, is calculated by subtracting this month’s principal payment from last month’s remaining balance. Let’s look at the second row.

The remaining balance is found by taking last month’s balance of $29,445.45 and subtracting this month’s principal payment of $557.32 to arrive at the new remaining balance of $28,888.13.

When is Amortization Used

An amortization schedule is used for all types of loans. Even loans, such as credit cards, that just show a minimum payment can have an amortization.

Someone who is working on paying off their credit card can use an amortization schedule or a loan payoff calculator to see how long it would take to pay it off, assuming a fixed payment.

The only problem would be if the credit card is used again because the loan balance will increase. In this case, a new amortization schedule would need to be set up, but it is still doable.

The amortization schedule is mostly used with other loan types, such as auto loans, student loans, and mortgages, that have a set payment and term. If all payments are made, these balances don’t increase and a single amortization schedule can be used until the asset is sold or paid off.

Frequently Asked Questions

Is amortization the same as depreciation?

Amortization is the paydown of a loan over time, while depreciation is used when an asset goes down in value over time. Depreciation is separate from a loan with amortization, and does not actually change the amount of money owed on a loan, it only changes the value of an asset. This can be explained in relation to machinery.

For example, a business may purchase a new machine and depreciate it over time, so it does not incur the total cost in one period.

If a business purchased a $100,000 machine and expects to use it for 5 years, it can depreciate $20,000 per year with the straight line depreciation method.

This smooths out its expenses over time and it won’t have to incur a $100,000 expense in the first year.

A vehicle owner can also think about depreciation when buying a car with a loan. If depreciation of the vehicle occurs faster than the loan amortization, the vehicle owner will be underwater, or have negative equity, on the loan.

This means they owe more than the car is worth and would take a loss if they had to sell. But if loan amortization occurs faster than the vehicle depreciates, the car is worth more than the loan. If they sell in this scenario, they would make money.

Can you make your own amortization schedule?

Using the calculator above is the easiest way to create an amortization schedule, however, you can make your own. You would need to know the loan amount, interest rate, and term.

You would divide the interest rate by 12 to find the periodic, or monthly, rate, and can then plug these numbers into the loan payment formula to find the total interest and principal payment for each month.

What are the types of amortization?

There are 5 common types of amortization: full amortization with a fixed rate, full amortization with a variable rate, full amortization with deferred interest, partial amortization with a balloon payment, and negative amortization.

Most loans, such as auto loans or mortgages, use full amortization with a fixed rate.

Do all loans have an amortization schedule?

Not all loans have an amortization schedule. Credit cards or lines of credit could have a minimum monthly payment, but may not have a set payoff date or even a set monthly payment, depending on the type of loan.

Source: Amortization Calculator