Most patrons and traders in Texas are unaware of the potential advantages that wraparound mortgages can provide within the property market. This inventive financing choice lets you take over an present mortgage whereas including by yourself, offering you with the chance to safe favorable rates of interest and fee phrases. By leveraging wraparound mortgages, you may improve your buying energy, enhance money move, and probably keep away from expensive pitfalls. In this information, you’ll learn to successfully make the most of this technique to maximise your success in Texas actual property.

Key Takeaways:

- Wraparound mortgages enable patrons to buy properties with out having to qualify for conventional financing, making them accessible for these with less-than-perfect credit score.

- This financing technique can typically present a aggressive edge within the Texas property market by permitting sellers to retain their present mortgage phrases whereas nonetheless attracting patrons.

- Cautious negotiation of the phrases is critical, together with rates of interest and fee schedules, to make sure that the wraparound mortgage is useful for each the client and the vendor.

- Conduct thorough due diligence to guage the prevailing mortgage’s phrases and make sure the vendor is correctly knowledgeable in regards to the implications of a wraparound deal.

- Consulting with a educated actual property lawyer or skilled might help navigate the complexities of wraparound mortgages and guarantee compliance with Texas actual property legal guidelines.

Understanding Wraparound Mortgages

Earlier than delving into the intricacies of wraparound mortgages, it is important to acknowledge their construction. A wraparound mortgage is a sort of financing the place a vendor’s present mortgage stays in place, and you’re taking a brand new mortgage that “wraps round” the prevailing one, permitting for streamlined funds and probably simpler qualification.

Forms of Wraparound Mortgages

If you’re exploring wraparound mortgages, there are a number of sorts to contemplate:

| Normal Wraparound | This includes a single vendor mortgage encompassing all present money owed. |

| Partial Wraparound | Solely covers a part of the prevailing debt, helpful for patrons with robust credit score. |

| Topic To | Purchaser takes over funds with out formally assuming the mortgage. |

| Proprietor Financing | Vendor acts because the lender, making the phrases extra versatile. |

| Adjustable Charge | Funds can range primarily based on market rates of interest. |

After figuring out the precise kind, you may make an knowledgeable choice that aligns together with your monetary objectives.

Key Elements to Take into account

Understanding wraparound mortgages requires you to guage a number of necessary points:

- Interest Charges: Examine charges to make sure affordability.

- Vendor’s Mortgage Phrases: Scrutinize the prevailing mortgage phrases, together with charges and length.

- Authorized Implications: Seek the advice of with professionals to grasp authorized obligations.

- Property Worth: Make sure the property sufficiently appreciates over time.

- Cost Construction: Make clear the fee schedule and any potential changes.

Understanding these elements lets you navigate wraparound mortgages with higher confidence.

To absolutely leverage wraparound mortgages in Texas, it’s good to take note of the rates of interest, which may considerably affect your long-term monetary commitments. It is also crucial to grasp the vendor’s mortgage phrases to keep away from sudden liabilities. Partaking with knowledgeable to align on authorized implications is important in defending your pursuits. Moreover, an correct appraisal of property worth will support in additional knowledgeable decision-making. Lastly, understanding the fee construction will information your month-to-month budgeting. Understanding the precise steps will guarantee a optimistic expertise in your property funding journey.

Step-by-Step Information to Implementing Wraparound Mortgages

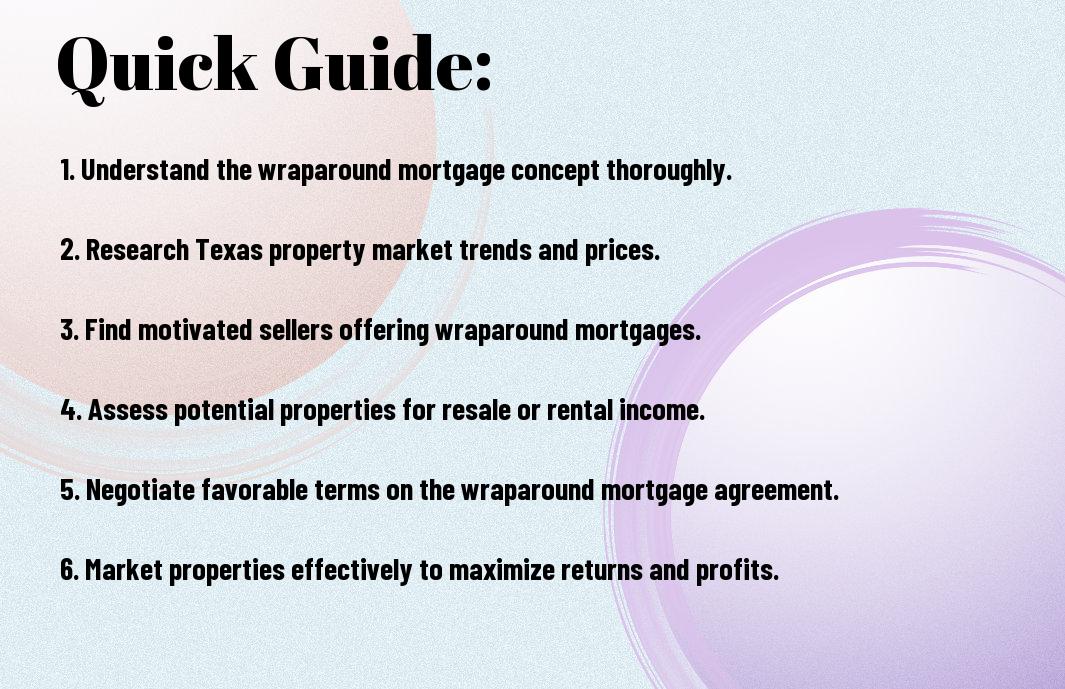

It’s essential to comply with a scientific method when implementing wraparound mortgages in Texas. Start by understanding key elements that have an effect on this financing technique, which may be outlined as follows:

| Steps | Particulars |

|---|---|

| 1. Assess Your Monetary State of affairs | Consider your creditworthiness and price range to find out the feasibility of a wraparound mortgage. |

| 2. Determine Potential Properties | Analysis properties the place this financing choice is viable, in search of motivated sellers. |

| 3. Draft the Wraparound Mortgage Settlement | Work with a authorized skilled to create a strong contract that outlines the phrases. |

| 4. Shut the Deal | Finalize the transaction, guaranteeing all paperwork are filed accurately and legally. |

Assessing Your Monetary State of affairs

On evaluating your monetary scenario, take an sincere take a look at your earnings, bills, and credit score rating. Understanding these parts will show you how to confirm the viability of adopting a wraparound mortgage. Take into account chatting with a monetary advisor to achieve insights into your debt-to-income ratio and establish potential roadblocks earlier than continuing.

Navigating Texas Actual Property Legal guidelines

To efficiently implement a wraparound mortgage in Texas, it’s good to be well-versed in native actual property legal guidelines and rules. Understanding the state’s necessities will preserve you compliant and alleviate authorized dangers.

Monetary rules can affect your capacity to safe a wraparound mortgage, so familiarize your self with Texas property legal guidelines, together with the Disclosure Necessities and potential Legal responsibility Points. Neglecting authorized intricacies can result in unexpected troubles reminiscent of critical disputes or contract voiding. All the time seek the advice of with a actual property lawyer to make sure that your agreements adhere to Texas statutes and shield your pursuits successfully.

Ideas for Leveraging Wraparound Mortgages Successfully

Many traders discover that leveraging wraparound mortgages can considerably improve their success within the Texas property market. To maximize your advantages, contemplate the next ideas:

- Perceive the authorized framework surrounding wraparound mortgages.

- Talk brazenly with sellers about your intentions.

- Consider the rates of interest and phrases of each loans.

- Analysis the market traits in your required areas.

This technique might help you construct wealth whereas navigating the complexities of actual property transactions.

Discovering the Proper Property

The proper property could make all of the distinction when using a wraparound mortgage. Search out properties in fascinating areas or those who have good potential for appreciation, and analyze the encompassing neighborhood to make sure it aligns together with your funding objectives.

Negotiating with Sellers

There’s typically room for negotiation when coping with sellers. Clear communication and showcasing your information of wraparound mortgages can create a good setting for dialogue.

As an illustration, when approaching a vendor, spotlight the potential advantages of accepting a wraparound mortgage as an alternative of a standard sale. Clarify the way it can present them with a gradual earnings stream whereas permitting you to amass the property while not having a big money upfront fee. Ensure that to evaluate the vendor’s motivations and be ready to deal with any issues they might have. By fostering a mutually helpful settlement, you may create a win-win state of affairs that may result in favorable outcomes for each events concerned.

Professionals and Cons of Wraparound Mortgages

After inspecting wraparound mortgages, it is necessary to weigh the advantages and downsides earlier than deciding if this selection fits your monetary technique. Beneath are key execs and cons to contemplate:

| Professionals | Cons |

|---|---|

| Simpler financing than conventional loans. | Increased rates of interest could apply. |

| Flexibility in phrases. | Complexity in authorized agreements. |

| Potential for decrease down fee. | Threat of vendor default. |

| Investment alternatives with out financial institution involvement. | Will not be accepted in all property gross sales. |

| Faster transaction closings. | Various state rules. |

Advantages within the Texas Property Market

Any savvy investor in Texas can profit from wraparound mortgages, as they supply distinctive benefits like simplified financing and decrease upfront prices. These advantages might help you safe properties and improve your portfolio with out relying closely on banks, permitting for quicker transactions and higher flexibility in negotiations.

Potential Dangers and Drawbacks

Even with the interesting points of wraparound mortgages, you need to contemplate potential dangers. Understanding these elements will put together you for any problems that will come up through the mortgage settlement course of.

Cons of wraparound mortgages embody financing challenges that may come up if the vendor defaults on their unique mortgage, probably leaving you in a troublesome place. Moreover, larger rates of interest could typically accompany these loans, rising your monetary burden over time. The complexity of authorized paperwork required may result in misunderstandings if not dealt with correctly, posing additional dangers. By being conscious of those conditions, you may navigate the wraparound mortgage panorama extra successfully.

Conclusion

The efficient use of wraparound mortgages can considerably improve your place within the Texas property market. By understanding the construction and advantages of wraparounds, you may negotiate higher phrases, enhance your money move, and even facilitate smoother transactions. This financing technique lets you leverage present loans to your benefit, creating alternatives to broaden your actual property portfolio. By strategically implementing wraparound mortgages, you may maximize your funding potential and navigate the Texas market with confidence.

FAQ

Q: What’s a wraparound mortgage and the way does it operate within the Texas property market?

A: A wraparound mortgage is a sort of seller-financed mortgage that permits a purchaser to make funds that “wrap round” an present mortgage. The vendor maintains the unique mortgage whereas creating a brand new mortgage that features the quantity of the prevailing mortgage plus any further financing required to buy the property. In Texas, this may be advantageous for patrons when conventional financing choices are restricted, permitting for extra versatile phrases and probably decrease rates of interest.

Q: What are the advantages of utilizing a wraparound mortgage for property funding in Texas?

A: Using a wraparound mortgage can present a number of advantages, together with simpler entry to financing for patrons with less-than-perfect credit score, the opportunity of decrease down funds, and the chance to barter favorable phrases instantly with the vendor. Moreover, sellers can profit from receiving regular money move whereas nonetheless retaining the unique mortgage, which can result in monetary benefits over time. This association may be notably useful in a aggressive Texas property market the place conventional loans could also be tougher to safe.

Q: Are there any authorized issues to bear in mind when utilizing wraparound mortgages in Texas?

A: Sure, when coping with wraparound mortgages in Texas, it’s crucial to seek the advice of with an actual property lawyer or a mortgage skilled aware of native legal guidelines. Texas has particular rules relating to actual property transactions and financing preparations. Each patrons and sellers should be sure that the prevailing mortgage doesn’t embody a “due-on-sale” clause, which may set off the lender to demand full compensation upon switch of the property.

Q: How can I discover properties which might be eligible for wraparound mortgages in Texas?

A: To discover properties appropriate for wraparound mortgages, you can begin by networking with native actual property brokers who’re aware of financing choices. Search for motivated sellers who could also be keen to supply vendor financing, and contemplate looking for properties in neighborhoods with excessive turnover charges or the place conventional financing could also be scarce. Moreover, on-line actual property marketplaces and categorized adverts may yield leads on properties the place sellers are open to wraparound mortgage preparations.

Q: What steps ought to I take to barter a wraparound mortgage deal in Texas?

A: Start by assessing your monetary scenario and understanding what you may afford. Analysis the property and the prevailing mortgage to grasp the phrases and potential dangers concerned. Method the vendor with a transparent proposal, outlining the advantages of a wraparound mortgage for each events. Be ready to barter phrases reminiscent of rates of interest, fee schedules, and any contingencies. Having an actual property lawyer or skilled actual property agent in your workforce can facilitate the negotiation course of and assist be sure that the deal is structured accurately.