This information will stroll you thru the essential advantages of title insurance coverage when investing in Dallas actual property. By understanding the position of title insurance coverage, you may safeguard your self in opposition to potential claims and hidden dangers which will jeopardize your funding. With the complicated nature of property possession, figuring out how one can defend your rights and guaranteeing clear title is significant for securing your monetary future. Learn on to find out how title insurance coverage is usually a essential part of your funding technique.

Key Takeaways:

- Title insurance coverage supplies monetary safety in opposition to potential authorized points associated to property possession, equivalent to undiscovered liens or possession disputes.

- Investing in title insurance coverage ensures that the client’s rights to the property are safeguarded from previous claims, unknown heirs, or different encumbrances which will come up.

- The means of acquiring title insurance coverage entails a radical title search, which reveals the property’s historical past and any present points that have to be resolved earlier than closing.

- In Dallas actual property, having title insurance coverage can improve purchaser confidence and streamline transactions, because it facilitates clearer property possession switch.

- Title insurance coverage is a one-time payment that may save property house owners from important monetary losses within the occasion of future claims in opposition to their property title.

Understanding Title Insurance

Earlier than buying a property, it is important to grasp the significance of title insurance coverage. Title insurance coverage performs an important position in safeguarding your authorized rights regarding a property, guaranteeing that there are not any unexpected points that might jeopardize your possession.

What’s Title Insurance?

On a primary stage, title insurance coverage is a type of indemnity insurance coverage that protects you in opposition to losses as a result of defects within the title of your property. It supplies peace of thoughts by overlaying unexpected claims, liens, or different obstacles which will hinder your possession rights.

Forms of Title Insurance Out there

Title protection is available in totally different varieties, tailor-made to guard numerous stakeholders in an actual property transaction. Listed below are a few of the essential sorts of title insurance coverage you may think about:

- Proprietor’s Title Insurance: Protects you, the client, from potential title points.

- Lender’s Title Insurance: Safeguards the lender’s curiosity till the mortgage is paid off.

- ALTA Title Insurance: Offers broader protection for each lenders and house owners.

- Brief-Time period Title Insurance: Covers non permanent possession or lease agreements.

- Previous Republic Title Insurance: A good supplier identified for complete protection.

Recognizing the precise sort of title insurance coverage is significant for guaranteeing your funding is sufficiently protected.

| Kind of Title Insurance | Description |

|---|---|

| Proprietor’s Title Insurance | Protects your possession rights in opposition to future claims. |

| Lender’s Title Insurance | Protects the lender’s funding till the mortgage is glad. |

| ALTA Title Insurance | Offers in depth protection for complete safety. |

| Brief-Time period Title Insurance | Covers non permanent possession conditions. |

| Previous Republic Title Insurance | A well known supplier with a strong popularity. |

Title insurance coverage affords extra than simply safety; it ensures the longevity of your property funding by tackling potential points earlier than they develop into important issues. By selecting the suitable sort of protection, you may safeguard your pursuits successfully.

- Complete protection: Helps you keep away from surprising title points.

- Monetary safety: Protects your funding from loss.

- Peace of thoughts: Lets you get pleasure from your property with out fear.

- 700,000+ claims paid: A testomony to the significance of protection.

- Authorized illustration: Some insurance policies supply this in case of disputes.

Recognizing the importance of title insurance coverage is usually a game-changer in safeguarding your actual property funding.

The Importance of Title Insurance in Real Estate

Assuming you are getting into the Dallas actual property market, understanding the significance of title insurance coverage is important. Title insurance coverage protects you from potential monetary loss that might come up from points associated to property possession, equivalent to prior liens, unresolved disputes, or fraud. By securing title insurance coverage, you may confidently navigate the complexities of actual property transactions whereas safeguarding your funding.

Key Advantages of Title Insurance

An essential advantage of title insurance coverage is that it supplies you with peace of thoughts. It protects you in opposition to monetary loss associated to possession claims, guaranteeing that you’re the rightful proprietor of your property. Moreover, it covers authorized charges incurred in defending in opposition to claims, making it a clever funding for anybody getting into the actual property market.

Protecting Towards Title Disputes

Protecting your funding by means of title insurance coverage means safeguarding your self in opposition to potential title disputes. With out correct protection, you possibly can face surprising challenges from third events claiming possession or asserting liens in your property.

With title insurance coverage, you achieve a powerful layer of safety in opposition to such claims. If a dispute arises, your insurance coverage will cowl authorized charges and bills concerned in defending your possession rights. Furthermore, title insurance coverage may also help resolve points with the property’s title earlier than they escalate, thus guaranteeing your funding stays safe and free from authorized entanglements. Finally, having title insurance coverage empowers you to spend money on Dallas actual property with higher confidence.

Components to Think about When Selecting Title Insurance

Your selection of title insurance coverage can considerably impression your actual property funding. Think about the next components:

- Protection limits

- Premium prices

- Declare course of

- Customer support

- Underwriter popularity

Any determination you make ought to align along with your property objectives and supply you peace of thoughts.

Protection Choices

Little consideration is usually paid to the number of protection choices obtainable, but these can tremendously have an effect on your funding’s safety. Not all title insurance coverage insurance policies are the identical, so it is necessary to grasp what’s included in your protection and any elective add-ons that may profit you in the long term.

Status of Title Insurance Corporations

On your peace of thoughts, the popularity of title insurance coverage corporations must be a prime precedence. Search for suppliers with a powerful observe file and constructive buyer suggestions.

The popularity of a title insurance coverage firm can tremendously affect your shopping for expertise. A well-regarded firm is extra more likely to supply environment friendly customer support, a easy claims course of, and strong protection choices. Test on-line critiques, ask for suggestions from trusted sources, and confirm their monetary stability. A title insurer with a strong popularity can safeguard you in opposition to potential pitfalls sooner or later, in the end defending your funding.

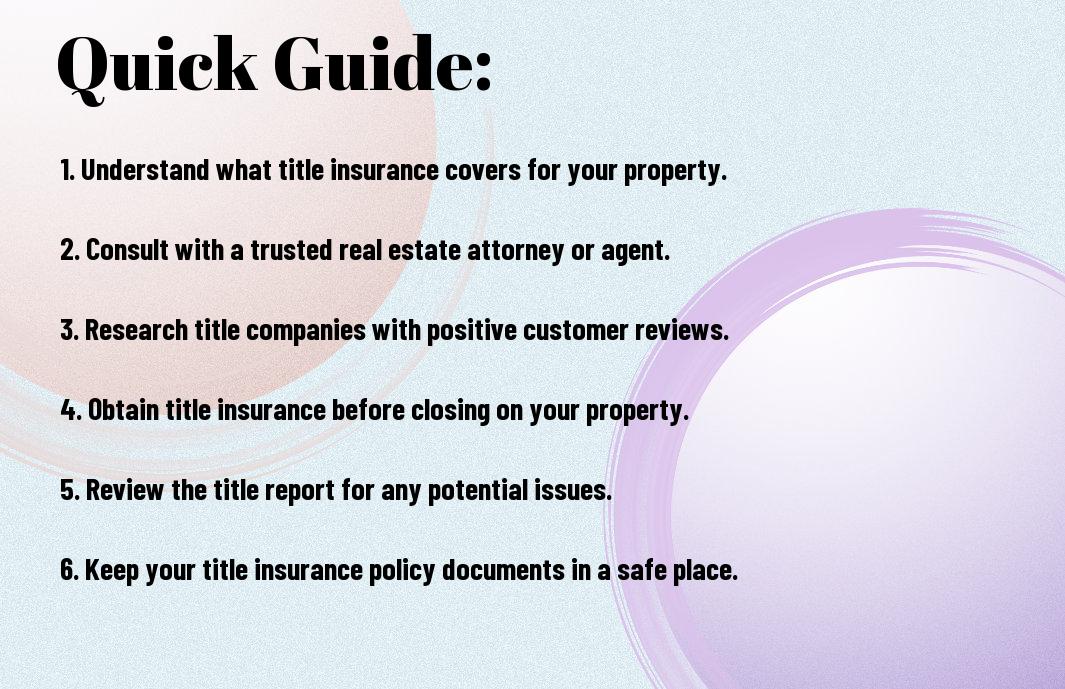

Suggestions for Maximizing Your Title Insurance

Not like many householders who overlook their protection, you may maximize your title insurance coverage by implementing a number of strategic suggestions. Think about the next:

- Perceive your coverage particulars totally.

- Keep knowledgeable about property data and potential claims.

- Talk commonly along with your title insurance coverage agent.

- Assessment your coverage upon renewal and make essential changes.

Figuring out the following pointers will assist guarantee your funding stays protected.

Reviewing Coverage Particulars

Particulars inside your title insurance coverage coverage are important to understanding the protection and exclusions. You must meticulously assessment clauses relating to potential claims and the steps essential for submitting. Being proactive in addressing any discrepancies or considerations will empower you to safeguard your funding successfully.

Looking for Skilled Recommendation

Reviewing your title insurance coverage coverage is vital, however searching for skilled recommendation can improve your understanding and fortify your safety. Consulting with a certified actual property legal professional or title agent can present precious insights into complicated clauses and potential dangers that you just may overlook. These specialists can information you on how one can navigate disputes or claims, guaranteeing you could have a complete grasp of your coverage.

Plus, working intently with professionals can reveal harmful gaps in your protection, permitting you to handle them earlier than they develop into important points. Their experience may also help you establish constructive methods to strengthen your title insurance coverage coverage, offering you with peace of thoughts and confidence in your actual property investments. Taking these steps will guarantee your rights and belongings are secured in opposition to unexpected issues.

Step-by-Step Information to Acquiring Title Insurance

Now, acquiring title insurance coverage can appear daunting, however following this easy information can streamline the method for you.

| Step | Motion |

| 1 | Discover a respected title insurance coverage firm. |

| 2 | Request a title search to uncover any potential points. |

| 3 | Assessment the title report for findings. |

| 4 | Choose the precise title insurance coverage coverage on your wants. |

| 5 | Full essential paperwork and pay your premium. |

| 6 | Obtain your title insurance coverage coverage and maintain it secure. |

Pre-Buy Guidelines

Title insurance coverage begins with a pre-purchase guidelines, the place you will wish to assess your financing choices, collect related property paperwork, and make sure you perceive the title insurance coverage protection wanted on your funding.

Navigate the Closing Course of

In your journey by means of the closing course of, it is important to stay knowledgeable about all points, together with the title insurance coverage part. This stage represents the ultimate step earlier than your homeownership turns into official and entails a number of vital paperwork.

It is vital to intently monitor the closing course of, as that is if you’ll finalize your title insurance coverage buy, guaranteeing safety in opposition to any future claims. Chances are you’ll encounter discrepancies within the title report that want addressing, which may delay the closing. All the time ask inquiries to make clear any uncertainties earlier than signing something. Test that the title firm holds a dependable popularity and confirms your possession rights upon closing. This proactive strategy ensures that you just perceive all obligations and advantages of your title insurance coverage coverage.

Professionals and Cons of Title Insurance

As soon as once more, it is vital to weigh the professionals and cons of title insurance coverage in your actual property funding. Understanding these components may also help you make an knowledgeable determination.

| Professionals | Cons |

| Protects in opposition to monetary loss from title defects | Further value on prime of closing bills |

| Covers authorized charges in case of disputes | Not all points could also be coated |

| Peace of thoughts in your funding | Coverage phrases might be complicated |

| Helps facilitate smoother closing | Non-transferrable should you promote the property |

| Could also be required by lenders | Restricted choices for personalisation |

Benefits of Having Title Insurance

Title insurance coverage supplies you with a security internet in opposition to surprising claims or disputes over property possession. By securing your funding, you may confidently transfer ahead with out the concern of hidden liens or undisclosed heirs.

Potential Drawbacks to Think about

For some, the price of title insurance coverage could really feel like an pointless expense, particularly should you imagine your property title is obvious. However, understanding the potential dangers is significant when making your determination.

Title insurance coverage won’t cowl each potential concern associated to your property, resulting in potential future disputes. This will embrace misinterpretations of coverage protection or exclusions that catch you off guard. It is also vital to notice that when you promote the property, the title insurance coverage coverage is now not legitimate, requiring a brand new proprietor to safe their very own protection. Therefore, fastidiously evaluating your particular state of affairs and potential dangers can information you in figuring out whether or not the funding in title insurance coverage really meets your wants.

Conclusion

Upon reflecting, it’s clear that title insurance coverage performs an important position in safeguarding your actual property funding in Dallas. By defending you from potential authorized points, undisclosed claims, or title discrepancies, this insurance coverage ensures peace of thoughts for you as a property proprietor. Investing in title insurance coverage is just not merely a formality; it’s an important step in securing your monetary future and sustaining management over your property. By prioritizing title insurance coverage, you may confidently navigate the Dallas actual property market with out fearing unexpected issues.

FAQ

Q: What’s title insurance coverage and why is it vital in Dallas actual property?

A: Title insurance coverage is a type of indemnity insurance coverage that protects actual property consumers and lenders in opposition to losses arising from defects in a property’s title. In Dallas, the place actual property transactions might be complicated, title insurance coverage safeguards your funding by guaranteeing that you’ve clear possession of the property and are shielded from potential authorized points regarding earlier house owners, unpaid taxes, or undisclosed liens.

Q: How does title insurance coverage differ from different sorts of insurance coverage?

A: Not like normal insurance coverage insurance policies that supply safety in opposition to future occasions, title insurance coverage supplies protection in opposition to points which will have occurred up to now. This implies it protects in opposition to defects, claims, or authorized disputes associated to the property’s possession historical past. Sometimes, a one-time premium is paid at closing, and the coverage stays in impact so long as you or your heirs maintain an curiosity within the property.

Q: Are there several types of title insurance coverage insurance policies?

A: Sure, there are typically two sorts of title insurance coverage insurance policies: the proprietor’s coverage and the lender’s coverage. The proprietor’s coverage protects the client’s funding within the property, whereas the lender’s coverage is required by the mortgage firm to guard their funding within the property as effectively. It’s common for each insurance policies to be obtained throughout an actual property transaction to make sure full protection.

Q: How can a purchaser select a good title insurance coverage firm in Dallas?

A: When choosing a title insurance coverage firm, consumers ought to think about components equivalent to the corporate’s expertise, buyer critiques, and their standing with the Texas Title Insurance Warranty Affiliation. It is also advisable to hunt referrals from actual property professionals, equivalent to brokers and lenders, who can advocate respected companies with a historical past of offering dependable service and clear communication.

Q: What steps do you have to take if a title concern arises after buying a property?

A: If a title concern involves mild after buying a property, step one is to contact your title insurance coverage firm. They will consider the declare and decide protection based mostly on the coverage you maintain. Generally, they’ll assume accountability for authorized charges and associated prices to resolve the problem. It is necessary to report any considerations to your insurer promptly to make sure you obtain the safety you paid for beneath your title insurance coverage coverage.