Exemption alternatives just like the homestead exemption can considerably cut back your property taxes in Dallas. By understanding and using this profit, you may successfully decrease your taxable worth and preserve extra money in your pocket. This information will give you the very important steps to qualify for the homestead exemption and maximize your tax financial savings. Whether or not you’re a new home-owner or simply seeking to save on property taxes, your proactive method can result in substantial monetary advantages.

Key Takeaways:

- Understanding the Homestead Exemption: Familiarize your self with how the homestead exemption works in Dallas, together with eligibility standards and the share of tax financial savings it presents.

- Income and Age {Qualifications}: Test your eligibility based mostly on elements like age, incapacity standing, and earnings; sure exemptions can be found particularly for seniors or people with disabilities.

- Utility Course of: Pay attention to the appliance course of and deadlines to make sure you submit your declare on time to learn from tax reductions.

- Further Exemptions: Discover extra exemptions that will apply, comparable to these for veterans or surviving spouses, as these can additional cut back your property taxes.

- Annual Evaluation: Repeatedly evaluation your property tax assessments and exemptions annually to make sure you are receiving all eligible advantages and to regulate for any modifications in your property standing.

Understanding the Homestead Exemption

Your understanding of the homestead exemption is prime to maximizing property tax financial savings in Dallas. This exemption is a authorized provision that permits householders to guard a portion of their residence’s worth from taxation, leading to decreased property tax payments. It’s designed to help householders, offering them with some monetary reduction whereas selling homeownership and neighborhood stability.

Sorts of Homestead Exemptions

- Common Homestead Exemption

- Over 65 Exemption

- Disabled Veteran Exemption

- Native Choice Exemptions

- Modified Homestead Exemption

Perceiving the various kinds of exemptions obtainable can assist you choose the suitable one to your scenario.

| Kind | Description |

| Common Homestead Exemption | Reduces the appraised worth of your property. |

| Over 65 Exemption | Further advantages for householders aged 65 and above. |

| Disabled Veteran Exemption | Offers exemptions based mostly on the veteran’s incapacity standing. |

| Native Choice Exemptions | Exemptions decided by native governments. |

| Modified Homestead Exemption | Particular provisions for particular circumstances. |

Eligibility Necessities

Homestead exemptions require you to satisfy particular eligibility standards to qualify for tax financial savings. Sometimes, you should personal and occupy your property as your major residence, relevant on January 1st of the tax yr. Moreover, you should be a resident of Texas and have filed for the exemption in accordance together with your native tips. For exemptions associated to age or incapacity, extra documentation could also be required to substantiate your declare.

A well-prepared software is important for receiving the homestead exemption advantages you deserve. Guarantee that you’ve all needed documentation, together with proof of identification and residency. Failure to offer correct info could result in your software being denied, which may end in shedding important financial savings. Therefore, preserve observe of deadlines and keep knowledgeable about any modifications to the exemption coverage in your space. Understanding these eligibility necessities will allow you to navigate the method easily and maximize your monetary advantages.

Elements Influencing Property Tax Savings

Whereas navigating the panorama of property taxes in Dallas, varied elements can considerably affect your property tax financial savings. Think about these influences:

- Property Exemption Eligibility

- Homestead Exemption Quantity

- Market Worth Fluctuations

- Native Tax Charges

This understanding can assist you maximize your financial savings.

Property Worth Concerns

Any enhance in your property worth can have an effect on your tax financial savings. The taxable worth of your property is instantly linked to its assessed worth, which means {that a} rise in property worth would possibly cut back the effectiveness of your homestead exemption. To guarantee you’re benefiting absolutely, it is smart to periodically evaluation your property’s assessed worth and dispute any discrepancies.

Location and Market Traits

With the ever-changing actual property market in Dallas, your property’s location performs a big function in figuring out property taxes. Neighborhood desirability usually drives residence values up, consequently rising tax assessments. Seasonal modifications and financial elements also can affect market traits.

Location is a key determinant of each your property worth and the general actual property market. Properties in high-demand areas are likely to expertise sharper will increase in worth in comparison with these in much less sought-after areas. As a house owner, it’s best to regulate native market traits, comparable to modifications in demand or latest gross sales in your neighborhood, which may instantly have an effect on your property taxes. Moreover, being conscious of native developments or zoning modifications can inform your understanding of potential future property worth shifts and tax implications.

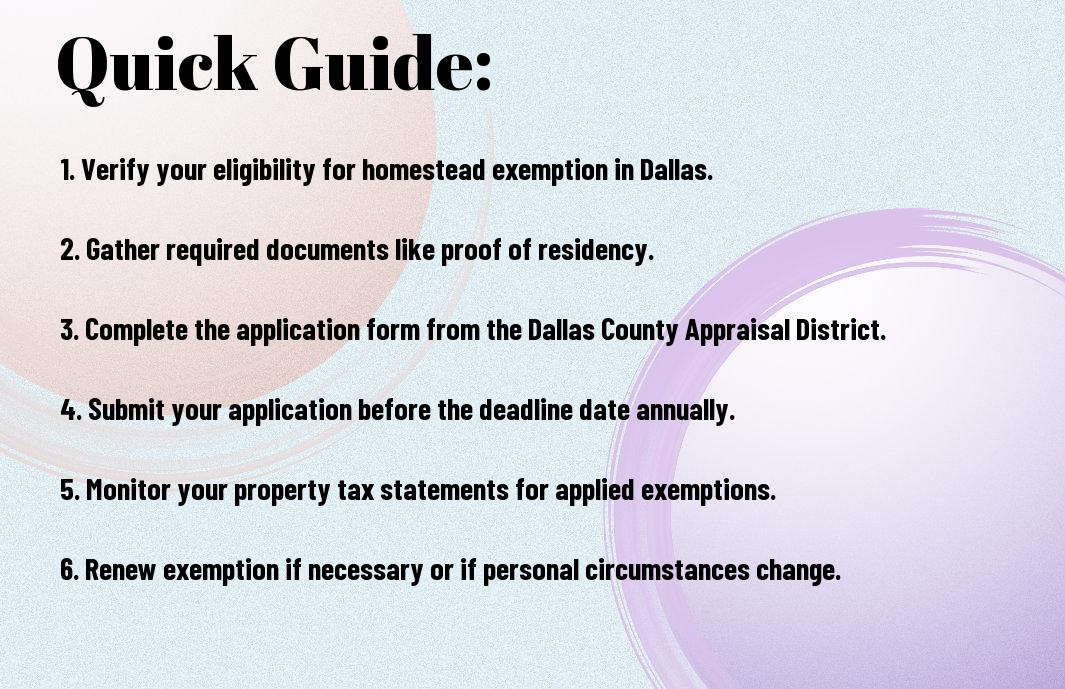

Step-by-Step Information to Making use of for the Homestead Exemption

Maintain the next steps in thoughts as you navigate the appliance course of for the Homestead Exemption:

| Step | Motion |

| 1 | Go to the Dallas Central Appraisal District (DCAD) web site. |

| 2 | Obtain and full the Homestead Exemption software type. |

| 3 | Submit your software by mail or in particular person. |

| 4 | Await affirmation of your exemption standing. |

Utility Course of

Any home-owner can apply for the Homestead Exemption by following these easy steps. Start by visiting the Dallas Central Appraisal District web site to entry the required software type. When you full the appliance, submit it both by mail or in particular person at your native appraisal workplace. After submission, you may anticipate to obtain affirmation of your exemption standing.

Paperwork Required

Utility for the Homestead Exemption requires particular documentation to confirm your eligibility. You have to proof of possession, comparable to a deed or closing assertion, together with private identification like a driver’s license. These paperwork assist to determine that you simply reside on the property you’re claiming.

Homestead exemptions can considerably decrease your property tax invoice, so make sure you present all required paperwork when submitting your software. In case you fail to incorporate essential paperwork, your software could also be denied or delayed. Maintain your neighborhood’s rules in thoughts, as native necessities could differ. At all times search an actual listing of obligatory paperwork wanted to keep away from any pitfalls within the software course of.

Ideas for Maximizing Your Savings

For optimum financial savings in your property taxes, contemplate these actionable ideas:

- Guarantee your property qualifies for the homestead exemption.

- File your software promptly to satisfy the deadline.

- Keep knowledgeable about native tax reductions and updates.

- Evaluation your property tax invoice for any errors.

- Maintain detailed information of all enhancements you make to your property.

Any diligence you apply right here can yield substantial outcomes.

Income and Household Dimension Impacts

One important issue influencing your eligibility for the homestead exemption is your earnings and household measurement. The thresholds could differ, and bigger households usually qualify for extra financial savings or reductions. Understanding how your distinctive scenario aligns with native tips will empower you to maximise your tax advantages.

Frequent Errors to Keep away from

You need to be cautious about sure pitfalls that would jeopardize your homestead exemption. Many owners fail to replace their software when household standing or earnings modifications, resulting in potential lack of advantages. Moreover, neglecting to file on time may end up in lacking out on important tax financial savings.

To absolutely profit from the homestead exemption, keep away from overlooking necessary updates to your private scenario that will have an effect on your eligibility. Maintain your software present in gentle of modifications in your loved ones or monetary standing. It is also very important to file your software inside deadlines; late submissions can imply shedding financial savings for the whole yr. Specializing in these features can significantly improve your total tax financial savings.

Professionals and Cons of the Homestead Exemption

After understanding the fundamentals, it is vital to weigh the professionals and cons of the Homestead Exemption earlier than you apply. The following desk outlines the strengths and weaknesses of claiming this profit:

| Professionals | Cons |

|---|---|

| Reduces property tax legal responsibility | Limitations on eligibility |

| Protects in opposition to rising residence values | Requires annual renewal in some instances |

| Could enhance your property’s attraction | May restrict sure property makes use of |

| Offers a monetary security internet | Exemption quantities could differ |

| Encourages homeownership | Not relevant for funding properties |

Benefits of Claiming the Exemption

Cons of evaluating the Homestead Exemption could lead you to miss its sturdy benefits. Claiming the exemption can considerably cut back your property tax legal responsibility, defending you from will increase attributable to rising residence values. Moreover, it serves as a monetary security internet, encouraging you to spend money on homeownership moderately than rental properties.

Potential Drawbacks to Think about

Benefits exist, however potential drawbacks to think about also can affect your determination concerning the Homestead Exemption. Chances are you’ll face limitations on eligibility based mostly on particular standards, hindering some householders from profiting from the exemption. Moreover, some exemptions require annual renewal, and the quantities exempted can differ, which might complicate planning to your funds.

Professionals of the Homestead Exemption embody its means to minimize your monetary burden by means of important tax financial savings. However, these financial savings might not be accessible to everybody attributable to restrictions on eligibility, or they could require you to observe particular tips. Be cautious of how the exemption can have an effect on your property utilization and whether or not annual renewals may current extra challenges for you.

FAQs concerning the Homestead Exemption in Dallas

In contrast to many different states, Texas presents a homestead exemption that may considerably cut back your property taxes. Understanding the specifics of the exemption in Dallas is essential for householders seeking to maximize their financial savings. Your eligibility, the forms of exemptions obtainable, and deadlines for making use of are only a few key features you may be interested by.

Frequent Questions

Even should you’ve heard of the homestead exemption, questions usually come up about the way it applies to your scenario. Frequent inquiries embody: What qualifies as your major residence? Is there a cap on how a lot your taxable worth may be decreased? How do you apply for the exemption? You could find clear solutions to those questions, empowering you to make knowledgeable selections concerning your property taxes.

Sources for Additional Information

Little-known assets can give you in-depth data concerning the homestead exemption. Official metropolis and county web sites, in addition to tax skilled blogs, usually have up to date info and useful guides on easy methods to navigate the method.

Plus, using web sites just like the Dallas Central Appraisal District presents you direct entry to types and deadlines. Native tax consultants also can present customized steerage tailor-made to your distinctive scenario. Maintain a watch out for neighborhood workshops, as they usually supply worthwhile insights and reply your urgent questions. These assets not solely make sure you keep compliant but in addition aid you maximize your potential financial savings on property taxes.

Conclusion

Conclusively, by understanding and successfully using the homestead exemption, you may considerably cut back your property tax burden in Dallas. Ensure to evaluate your eligibility, full your software, and keep knowledgeable about any related modifications or deadlines. Leveraging this necessary profit not solely offers you with fast monetary reduction but in addition encourages long-term stability to your property investments. Take the initiative to maximise your financial savings right now.