It’s possible you’ll discover actual property investing in New York to be profitable, however overlooking tax implications can considerably affect your income. Navigating the complicated tax panorama requires a eager understanding of deductions, reporting necessities, and native rules. By avoiding frequent tax pitfalls, you may improve your funding technique and guarantee compliance whereas maximizing your returns. On this weblog submit, we’ll discover key tax errors that may have an effect on your backside line and supply actionable insights that will help you navigate your actual property ventures extra successfully.

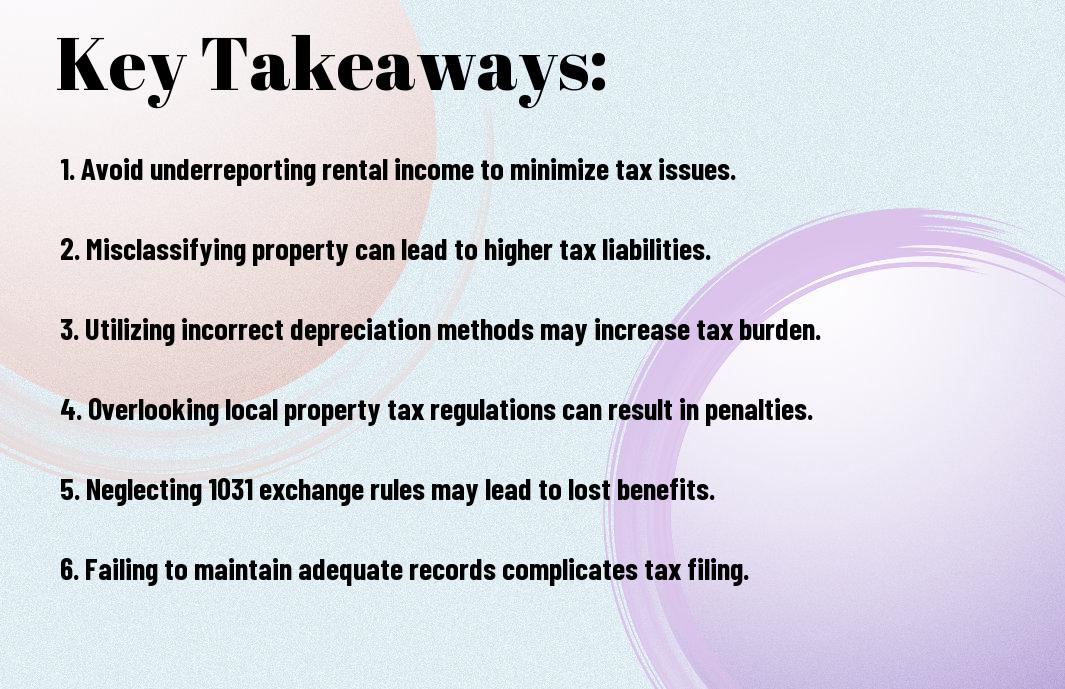

Key Takeaways:

- Perceive Deductions: Familiarize your self with which bills are deductible, together with property administration charges, repairs, and depreciation.

- File-Holding: Keep detailed data of all transactions, as correct documentation is vital for tax reporting and audit safety.

- Property Classification: Concentrate on the tax implications associated to property classification (residential vs. business), as they will considerably have an effect on tax legal responsibility.

- Capital Features Taxes: Plan for capital positive aspects taxes on the sale of properties; the timing and technique can decrease tax burdens successfully.

- Native Tax Legal guidelines: Keep up to date on native and state tax legal guidelines in New York, as actual property rules can change and affect funding profitability.

Understanding Tax Obligations

Earlier than plunging into actual property investments in New York, it is essential that you just perceive your tax obligations. These can range primarily based on the kind of property, your funding technique, and the revenue generated. Correctly managing these obligations will assist keep away from potential pitfalls that will hinder your monetary success.

Property Taxes

Between New York Metropolis’s notoriously excessive property taxes and ranging charges throughout counties, evaluating these prices is significant. You ought to be ready for fluctuations and be sure that you price range accordingly to stop tax delinquency.

Earnings Taxes

After producing revenue out of your actual property investments, you need to tackle revenue taxes, which may have a major affect in your total earnings. You’re required to report rental revenue and also can deduct bills associated to property administration.

Additional, it is vital to notice that New York State and Metropolis have their very own revenue tax charges, which could be comparatively excessive in comparison with different states. As an investor, the deductions you declare can considerably decrease your taxable revenue, so hold detailed data of upkeep prices, property administration charges, and repairs. Failure to know these tax implications can result in surprising liabilities, diminishing your anticipated returns.

Common Deductions and Credit

One of many key elements of tax planning for actual property traders in New York is knowing the frequent deductions and credit obtainable to you. Embracing these alternatives can assist optimize your tax scenario and increase your total return on funding. For extra insights on this subject, try this useful resource on Tax Errors New Real Estate Investors Have to Avoid.

Deductible Bills

By sustaining detailed data of your property-related expenditures, you may successfully scale back your taxable revenue. This contains bills corresponding to mortgage curiosity, property administration charges, and repairs. Holding a detailed eye on these prices ensures you maximize your deductions.

Tax Credit for Real Estate Investors

However, tax credit can present a direct discount in your tax legal responsibility, making them a invaluable asset to your monetary technique. Numerous credit could apply relying in your particular investments and actions inside New York.

Essentially the most notable tax credit for actual property traders embody the Low-Earnings Housing Tax Credit score and vitality effectivity credit for property enhancements. For those who interact in tasks that revitalize city areas or improve environmental sustainability, claiming these credit can considerably decrease your tax invoice. Not solely does this help in preserving money movement, however it could additionally contribute to long-term profitability to your investments, making it essential to discover all relevant tax credit totally.

Avoiding Common Errors

As soon as once more, try to be vigilant in regards to the frequent errors that actual property traders make. Avoiding these pitfalls can prevent a major sum of money and stress in the long term. It is vital to be proactive in educating your self about your tax obligations and figuring out potential areas of concern earlier than they turn into pricey errors.

Misclassifying Property Varieties

As soon as once more, it’s essential to be cautious about misclassifying property sorts. Doing so can result in inappropriate tax therapies and better liabilities. Listed below are some pitfalls to keep away from:

|

|

|

|

|

|

|

|

|

|

Any misdiagnosis of your property can result in pricey tax implications, so at all times classify your properties accurately.

Neglecting Depreciation

Above all, you need to concentrate on the significance of depreciation in actual property investing. Usually neglected, failing to trace depreciation can lead to pointless tax funds and missed deductions.

It’s crucial that you just precisely calculate depreciation to your properties. This non-cash deduction can considerably scale back your taxable revenue, resulting in substantial tax financial savings. By understanding the elements of depreciation, together with the right strategies and timelines, you make sure that you maximize your investments. For those who neglect to maintain monitor of this very important element, you could find yourself with the next tax invoice than needed. Any financial savings misplaced in errors can affect your total monetary progress in actual property.

File-Holding Finest Practices

All profitable actual property traders perceive the significance of meticulous record-keeping. By organizing your monetary paperwork, property bills, and rental revenue successfully, you may simplify tax preparation and keep away from undesirable points with the IRS. Implementing good practices in record-keeping additionally means that you can monitor your investments’ efficiency and make knowledgeable selections in your actual property journey.

Significance of Documentation

By sustaining thorough documentation, you create a stable basis to your actual property portfolio. Correct data can substantiate deductions, shield you in case of audits, and provide perception into your monetary panorama. Moreover, complete documentation can strengthen your place when searching for financing or promoting properties.

Tools for Environment friendly File-Holding

Round actual property investing, utilizing the appropriate instruments can prevent time and stress. Many traders flip to accounting software program, cloud storage options, and property administration apps to streamline their record-keeping processes. These instruments not solely automate calculations but in addition enable for simple categorization and retrieval of paperwork when wanted.

One other invaluable facet of environment friendly record-keeping is leveraging expertise to simplify your workflow. Using particular software program like QuickBooks or Buildium can streamline your accounting processes, serving to you monitor revenue and bills in real-time. Moreover, cloud storage providers can guarantee your paperwork are securely saved and accessible from anyplace, decreasing the danger of loss. Automated record-keeping instruments also can remind you of vital deadlines, permitting you to remain forward of tax obligations and keep compliance effortlessly.

Navigating New York-Particular Tax Legal guidelines

Not adhering to New York’s distinctive tax rules can considerably affect your backside line as an actual property investor. It is necessary to know the actual pointers set forth by the state and native municipalities to keep away from pointless penalties. You need to hold abreast of adjustments in tax codes and the way they have an effect on your investments, making certain you handle your monetary obligations successfully.

Native Tax Laws

Laws differ throughout the assorted localities in New York, presenting a patchwork of tax legal guidelines that you just, as an investor, should navigate. From property taxes to native enterprise taxes, being conscious of those particular guidelines is significant to sustaining compliance and maximizing your funding returns.

Influence of State Taxation

Among the many numerous elements that may have an effect on your funding returns, understanding the implications of New York State taxation is critical. The state taxes property at comparatively excessive charges in comparison with the nationwide common, which may eat into your income if not correctly managed.

In actual fact, New York’s state revenue tax can attain as much as 8.82% for top earners, plus there’s an actual property switch tax that may add to your prices. Failing to contemplate these monetary obligations can result in surprising encumbrances in your money movement. By diligently making ready for these tax liabilities, you may optimize your funding technique whereas making certain compliance with state legal guidelines.

Partaking Skilled Assist

After investing in actual property, navigating the complicated tax panorama could be overwhelming. Partaking skilled assist corresponding to tax advisors and actual property accountants is vital to maximise your income and decrease your liabilities. These specialists can present tailor-made methods and insights to maintain you compliant whereas optimizing your tax scenario, making certain you keep away from pricey errors and penalties.

When to Seek the advice of a Tax Advisor

By discovering the appropriate second to seek the advice of a tax advisor, you can also make knowledgeable selections that align together with your funding methods. A tax skilled could be invaluable throughout main transactions, corresponding to property acquisitions or gross sales, in addition to throughout tax season when making ready your returns. They will additionally help you with year-round planning to optimize your tax scenario.

Selecting the Proper Professionals

An efficient strategy to deciding on professionals to your actual property tax wants is to prioritize these with specialised expertise. Search for people who’ve a robust background in actual property investing and tax legislation, because it straight pertains to your monetary pursuits. Their information can assist you navigate New York’s particular rules whereas making certain you take benefit of accessible deductions and credit.

Choosing the proper professionals is vital to your long-term success. Begin by searching for suggestions from fellow traders or actual property professionals in your community. Make sure that the specialists you take into account have constructive critiques and thorough information of New York actual property legal guidelines. You also needs to talk about their payment constructions upfront to keep away from surprising prices later. A well-chosen tax advisor or accountant could make a major distinction by figuring out tax-saving alternatives and serving to you keep compliance with tax rules, finally contributing to your monetary success.

Summing up

Therefore, staying knowledgeable about frequent tax pitfalls can considerably improve your success as an actual property investor in New York. By understanding the intricacies of property taxes, deductions, and potential loopholes, you may higher safeguard your investments and maximize your returns. Guaranteeing correct record-keeping, consulting with tax professionals, and being aware of adjusting rules will assist you to navigate complexities whereas minimizing your tax liabilities. Taking these proactive measures means that you can focus in your funding technique with out the burden of surprising tax points.

FAQ

Q: What are some frequent tax deductions that actual property traders in New York usually overlook?

A: Real property traders in New York incessantly miss tax deductions associated to repairs and upkeep, property administration charges, and depreciation of the property. Moreover, prices related to journey for property administration or conferences, in addition to dwelling workplace bills if relevant, could be deducted. It is vital to maintain thorough data of all bills to maximise potential deductions.

Q: How does New York’s property tax system affect actual property traders?

A: New York’s property tax charges could be fairly excessive in comparison with different states, impacting internet revenue for actual property traders. Investors ought to concentrate on the potential for property tax will increase attributable to market worth reassessments. Recurrently reviewing property assessments and understanding the attraction course of can assist traders keep away from unexpected tax burdens.

Q: What tax implications ought to traders take into account when promoting an funding property in New York?

A: When promoting an funding property, traders should account for capital positive aspects taxes, which could be vital. New York State additionally imposes a switch tax on property gross sales, which varies primarily based on the sale worth. Investors can also wish to discover 1031 exchanges to defer capital positive aspects taxes by reinvesting proceeds into one other funding property. Consulting with a tax skilled can assist navigate these complexities.

Q: Are there particular tax advantages obtainable to actual property traders in New York?

A: Sure, New York gives numerous tax incentives for actual property traders, such because the Empire State Jobs Program and the New York State Historic Tax Credit score for rehabilitating historic properties. Moreover, some native jurisdictions could have their very own incentives, corresponding to property tax abatements for brand spanking new growth or main renovations. Investors ought to analysis these alternatives to take full benefit of accessible advantages.

Q: What are the pitfalls of co-mingling private and funding bills for tax functions?

A: Co-mingling private and funding bills can result in vital tax problems and potential audits. This apply makes it difficult to obviously establish deductible bills and can lead to disallowed deductions or elevated scrutiny from tax authorities. Investors ought to keep separate financial institution accounts and bank cards for his or her enterprise actions to make sure readability and compliance throughout tax submitting.